THE IMPORTANCE OF CORPORATE GOVERNANCE

What it is, and Why it Matters for Startups

You may have seen the headlines about FTX, the cryptocurrency exchange that spectacularly collapsed in 2022. Up until its failure, this company was viewed as a huge success. Its founder became the 60th richest person in the world and the company had an enviable list of big-name investors on its capitalization table.

The new CEO brought in to administer the clean-up of the company assets after its collapse said this about the company’s governance:

“Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here.”

This is an extreme example of poor governance when viewed in hindsight, but what is good governance? How can you make sure you’re on the right track in setting up effective governance?

What is Corporate Governance?

Corporate governance is the framework put in place by business leaders to provide organisational oversight. It is the set of rules, controls, policies, and resolutions that direct corporate behaviour.

The purpose of governance is to ensure good corporate discipline. It results in accountability to all stakeholders including investors, employees, regulators, customers, and the wider community in which a company operates.

Why Does It Matter?

If you believe that “how you do one thing is how you do everything”, then good governance is just another thing founders do to improve the chances of building a successful company. Governance that is done appropriately for the company indicates to stakeholders that other business processes like planning, financial controls, document management, and many other elements of building a strong foundation are also done well.

Looking at it from the other side, companies with poor governance:

- struggle to attract investment,

- generally grow slower,

- are subject to more and diverse risks,

- fail to recognize or resolve issues effectively, and

- tend to underperform.

Stated bluntly, companies with poor governance are less likely to succeed.

Who is Responsible?

Everyone has a role to play in governance. However, there are three main stakeholders within a corporation: Shareholders, Directors, and Officers.

Normally, Shareholders have limited control in the corporation, so they elect Directors to act in a supervisory and stewardship role.

Directors delegate authority to run the daily operations of the company to the Officers, who are the key executives of the company.

Directors and Officers have a fiduciary duty, and a duty of care that are owed to the corporation and the Shareholders.

Fiduciary Duty – requires them to act in good faith with the best interest of the corporation in mind. They must avoid conflicts of interest and disclose relevant information. They must maintain confidentiality.

Duty of Care – requires them to operate with diligence and skill that a reasonable person would operate.

There are some key differences between Canadian and US laws around fiduciary duty. In the US, a board’s fiduciary duty is primarily to the Shareholders. In Canada, it is to the company, which includes debt holders, employees, the community, and environment.

Four Lines of Sight

Boards of directors have an important role to play in the evolution of a company, which can be summarized in the following “four lines of sight”.

- Oversight – The board collectively provides oversight, which is about exercising stewardship, monitoring performance, and ensuring compliance.

- Insight – Individual directors provide insight when they challenge the status quo, draw meaning from information, and provide advice and suggestions.

- Foresight – Directors’ foresight is all about understanding trends, recognizing threats, and trying to position the organization for the future.

- Hindsight – Directors use hindsight when they reflect on the past, seek to understand something that has already occurred, and help others learn from the experience.

Aspects of Corporate Governance

Let’s dig deeper into what is involved in good governance.

For Directors, examples include:

- Providing the “four lines of sight” (oversight, insight, foresight, and hindsight).

- Assessing risks to the company and its stakeholders.

- Being involved in setting the overall strategy of the company.

- Approving the compensation of Officers and reviewing their performance.

- Approving financial transactions, stock issuances and disposition of intellectual property.

- Participating in board evaluations.

For Officers, examples include:

- Timely financial reporting to Directors and Shareholders.

- Robust procedures and policies to manage risks in the day-to-day operations of the business.

- Holding an Annual General Meeting in line with legal requirements including notification dates, access requirements, and proxy management.

For Shareholders, examples include:

- Election of Directors at the Annual General Meeting.

- Reviewing and approving financial statements at the Annual General Meeting.

- Appointment of an auditor at the Annual General Meeting.

When to Develop Governance Practices?

Often founders suggest it is too soon to worry about governance in an early-stage startup.

However, we see governance as foundational to startup success. It is good governance that sets the stage for growth.

The systems and processes that enable growth are also the foundation for accountability and transparency.

As soon as a company raises external capital, a board of directors is needed to support the Officers in their commercialization journey. The board provides fiduciary oversight on behalf of investors and stakeholders.

Good Directors have the benefit of previous experience and diverse perspectives. They often provide Officers with foresight into unanticipated risks and challenges. Then Directors and Officers can work together to identify options and potential solutions more quickly, often by facilitating introductions to potential investors, customers, advisors or suppliers.

A board provides a forum with structured time to speak about the future, which helps guide Officers to make more impactful decisions and actions.

Companies may survive with poor governance, but they’ll likely need to work much harder than those with effective structures in place.

What is the Right Level of Governance?

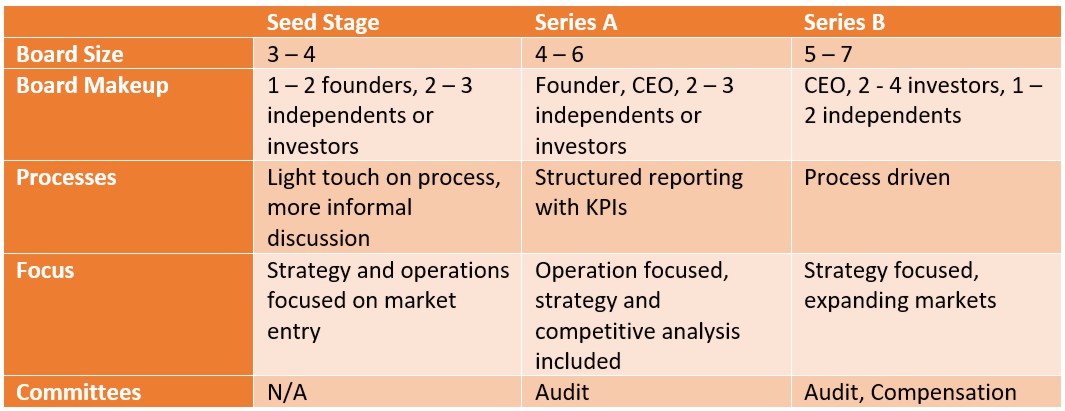

All corporations need a base level of governance. The following table provides guidelines to consider as you grow in revenue, team size and capital raised. Your governance processes should grow as you do.

In early-stage companies, the focus is on product development, operations, and driving and managing growth, as Officers learn and adapt to their target market. Governance at this stage is about simplifying processes, and ensuring a solid baseline of financial forecasting, reporting and risk management. Good governance establishes credibility for future capital raises.

As companies grow, governance shifts to include more strategic and structured processes with consistent reporting, beyond financial metrics.

There is greater focus on Officer accountability, with an increased focus on protecting Intellectual Property and identifying sources of competitive advantage.

When companies are scaling, governance should be process-driven with the sole focus on strategy to create more value. Formation of specific committees are leveraged to optimize governance workloads.

How to Select a Board of Directors?

Establishing an experienced and effective board of directors for a startup company is challenging, as funds are limited and there is little compensation for board members. Boards are often made up of major shareholders, who contribute their time and expertise as they already have a vested interest in the path forward and outcome.

However, including independent directors is important as they are often industry experts who do not have a vested interest in the company (i.e. they are not officers or major shareholders), and can then provide more independent and unbiased advice, perspective, and judgment.

A board’s fiduciary responsibility is to the company, however Directors who are also Officers and Shareholders have to manage their conflicts of interest and focus on what is best for the company. This too is an area where independent directors, with no conflicts of interest, provide valuable perspective.

One way to think about building a Board is to address skills and experience gaps in the founding team.

Even within mature and established boards, a skills matrix is commonly used to identify the breadth of relevant skills on a board and to identify important gaps. For example, the founding team may have very strong technical experience, but lack expertise in commercialization. Adding a board member with commercialization experience can streamline the process and accelerate growth.

Similarly, at a later stage, it will be important to have a board member with significant accounting experience. They can lead the audit committee, which has oversight of the company’s financials.

What does Carrot Ventures Bring to the Table?

People generally look to Venture Studios for help commercializing intellectual property. But studios also serve an invaluable role as highly qualified and experienced members of a new company’s board of directors. They will help streamline and accelerate the governance development process.

The absence of mature governance structures is one of the leading reasons investors fail to support promising ventures.

One of the core contributions Carrot Ventures makes is to set companies up from day one with the governance structures investors expect to see before they invest.

All of Carrot’s portfolio companies are established with a baseline of corporate governance, which evolves over time as the company grows and matures. Carrot starts each company by providing hands-on expertise in governance structures to:

- Hire an experienced CEO to lead each company,

- Establish a Board of Directors,

- Formalize essential processes and reporting.

What Actions Should You Take?

If you are running an early-stage company and are looking to enhance governance practices, consider the following:

- Seek an experienced CEO, and ask them about early-stage governance challenges – what do they wish they had done?

- Call a potential investor and ask for their perspective on governance and what they look for.

- Ask yourself if your governance activities are adding value or holding you back.

Carrot Ventures provides a full suite of foundational support to portfolio companies. This includes engaged governance and hands-on experience to build the right processes and financial controls.

If you have developed an agricultural technology that has significant market potential and would like to learn more about Carrot Ventures, download our e-book or contact us to discuss your innovation.