A COMPELLING OPTION

For Commercializing AgTech

Over the last 20+ years, Verdex Capital has invested in over 120 companies, and in 10 venture capital funds. Verdex Capital’s portfolio companies have raised in excess of one billion dollars in capital, with dozens of exits completed. In the process, Verdex evaluated thousands of technologies and companies. Being on the venture capital side of the table, we’ve seen what institutional investors look for, and which red flags steer them away from otherwise promising opportunities.

In the process, we’ve witnessed startup after startup struggle with raising investment capital.

The most common of these challenges include:

- Uncompelling value propositions

- Inexperienced CEOs and management teams

- Complicated corporate and capital structures

- Lack of governance and oversight, and

- Limited ability to raise capital

Any one of these challenges makes it difficult to raise capital. In combination, it becomes nearly impossible to attract investors and commercialize otherwise viable innovations.

What’s the Solution?

In response to these challenges, Verdex Capital launched Carrot Ventures. The goal is to eliminate the most predictable and troublesome barriers to investment.

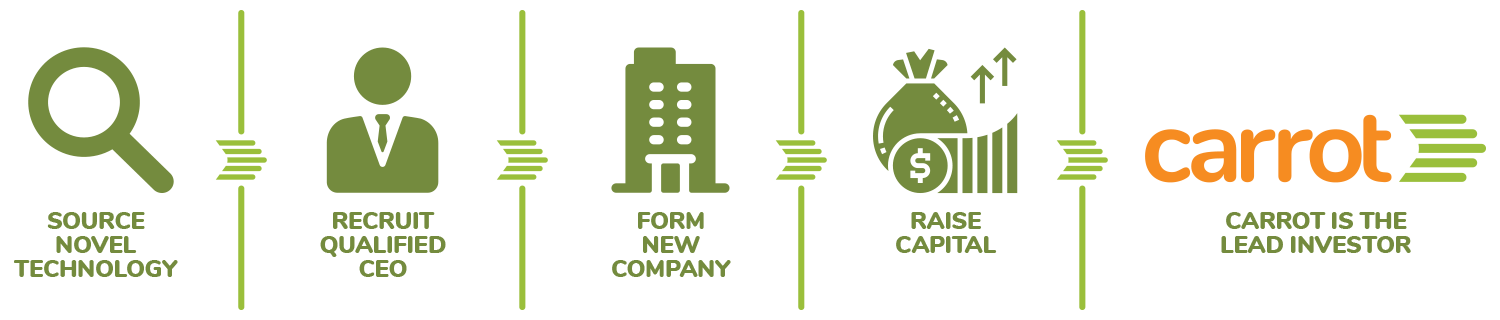

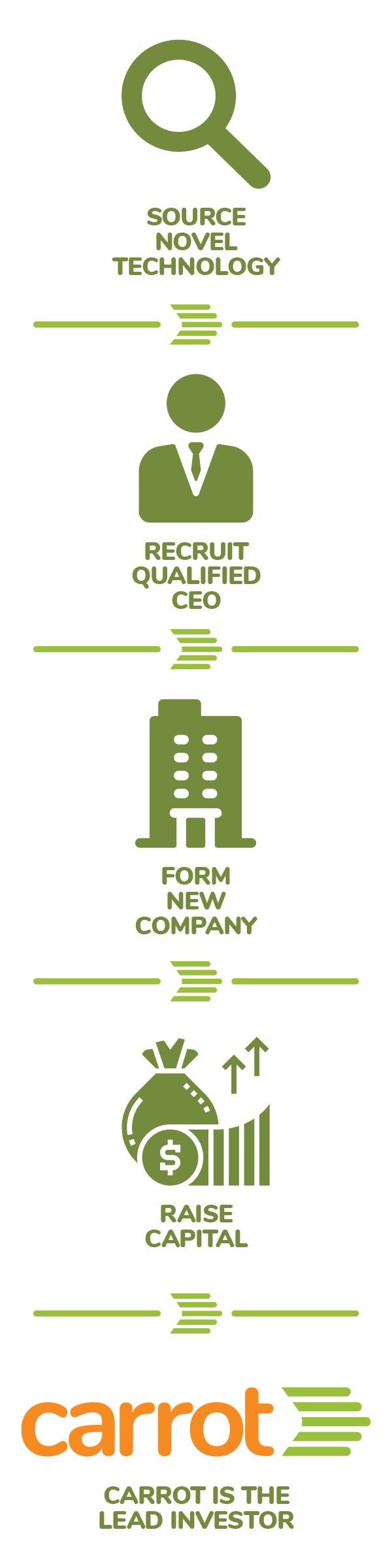

The solution is the Carrot Company Formation Model.

The Company Formation Model:

- Aligns value propositions with real market problems

- Recruits an experienced CEO to lead each company

- Creates a clean corporate and capital structure

- Establishes appropriate governance, and

- Ensures sufficient seed round investment

What About the IP Owners?

Intellectual property owners participate through an equity stake in the new company Carrot forms. IP owners become significant shareholders in the new venture, while letting someone else commercialize their innovation.

This model will not appeal to those who aspire to be entrepreneurs. However, for those who would rather someone with a proven track record commercialize their innovation, the Carrot model is compelling.

Inventors participate in the equity growth, the same as everyone else. They reap the benefits of their innovation, without having to build a team, or focus on marketing, sales, financing, and everything else involved in building a company.

What About the Recruited CEOs?

The recruited CEOs take on the role of Founder. They prepare the business plan, raise the capital, and commercialize the technology. The “carrot” for them is also equity growth.

The beauty of the company formation model is the alignment of interests between Inventors / IP Owners, CEOs, and Investors. It also means that everyone involved contributes to the areas they know best.

What About Investors?

Carrot ensures each opportunity can withstand a rigorous due diligence process, and leads the first round of financing.

AgTech investors can expect well prepared and attractive opportunities, worthy of their time and consideration.

Selecting Technologies

The starting point is attracting and vetting promising agricultural technologies.

Carrot defines AgTech very broadly. It’s anything from “Farm to Fork”. This includes technologies related to animal health, crop production, digital agriculture, food safety and logistics, food tech, and value add products.

The current focus is on Canadian AgTech innovation, but we’ll entertain great opportunities from anywhere, as long as they have some relevance to the Canadian agricultural sector.

The technologies must solve real market problems, have compelling value propositions, and as a rough guide be able to generate market traction within about 2 years.

Who is Carrot Best Suited For?

There are four types of AgTech IP owners that fit the model well. These are:

- Researchers and Inventors

- Technology Transfer Offices

- Early-Stage Companies

- Corporations

Researchers and Inventors

This could be a researcher at an institution, an intrapreneur, or an individual inventor. The common thread is they generally want to pursue other interests, or don’t want to be a founder/CEO. Whatever the motivation, this means being willing to exchange their invention for shares in a new company, and trust that Carrot Ventures will recruit leadership with proven skills and ability to convert the technology’s promise into commercial success.

Technology Transfer Offices

Carrot represents an ideal partner for institutions engaged in agricultural research. Carrot vets promising IP for commercial potential and provides a de-risked avenue to commercialization.

Early-Stage Companies

The opportunity for an incorporated company is to vend their IP into a new CarrotCo where the technology gets the attention and support it deserves.

IP owners become significant shareholders in the CarrotCo and benefit from equity growth.

Corporations

For corporations, the rationale is to profit from non-core R&D assets by letting Carrot form and finance a company to commercialize the innovation. The opportunity is to capitalize on stranded or otherwise under-utilized intellectual property.

When is Carrot Not a Fit?

Carrot is not a fit for:

- Existing companies in need of financing

- Innovations with no connection to the Canadian agriculture and food value chain

- Solutions that do not scale

- Technologies facing a long regulatory approvals process

- Founders seeking to maintain a controlling interest or leadership role

What’s the Catch?

There is no catch.

The only hurdle for people to get over is whether they wish to build a company on their own, or let someone else build it.

The Carrot approach is about reducing risk and expediting the commercialization process for everyone involved in the venture.

To explore the potential, please visit CarrotVentures.com. Consider downloading the eBook to share with your colleagues.